Summary of Key Information

What we do for you

We look at everything you’ve provided to us to work out whether your claim meets our criteria for us to represent you. If your claim meets our criteria, we will complain to your bank or the responsible bank on your behalf

If we disagree with their response, we may take your claim to the Financial Ombudsman Service (FOS)

What we need you to do

Tell us what happened and send us documentation we need to process your complaint. Tell us if the bank contacts you about your case, especially if it’s regarding the outcome of your complaint and you receive a rejection, offer or full refund. Tell us if your name, address, email address or other contact details change.

Timescales

Timescales vary depending on whether your case is settled by the bank or the FOS. Your case could be resolved as quickly as a few days, but could take up to two years. Generally, cases take between 6 to 12 months.

Updating you on your case

We will update you at key milestones. This is typically when your case progresses to a new stage, we get an update from the bank / FOS on your case, we require additional information, or anything that might be relevant. We will keep you updated on progress via emails and phone calls, and update you at least every 6 months (although normally much more often).

You can do this yourself

You do not need to use Demo or anyone else. You can do this yourself for free by complaining to your bank directly, and referring it to the Financial Ombudsman Service for a review if you are unhappy with the response

Cancellation

You can cancel free of charge at any time unless a redress offer has been made on your case

Fees

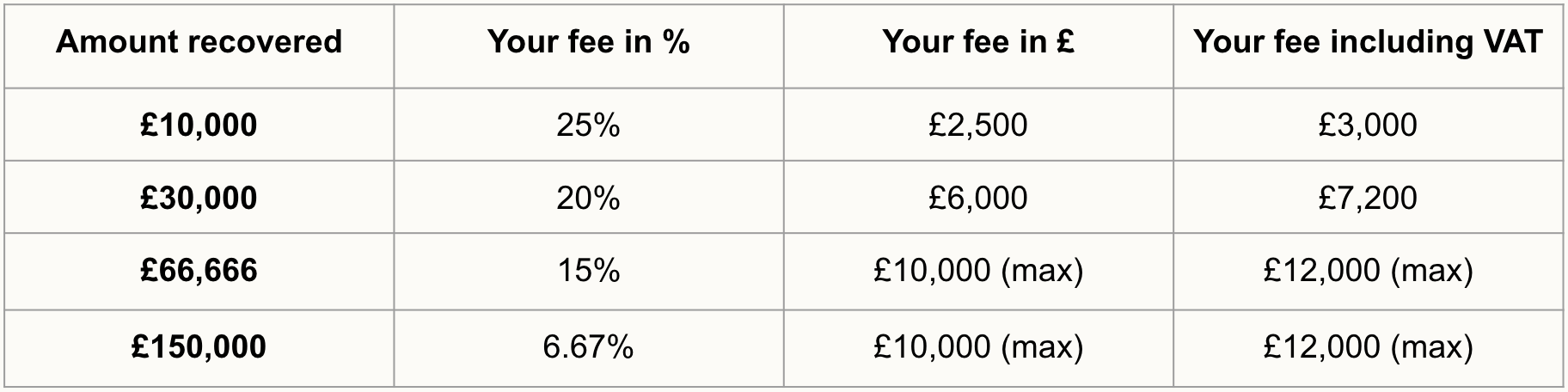

We charge between 15% and 25% plus VAT based on the amount of money you get back per case. We never charge more than £10,000 + VAT per case. You pay nothing if you aren’t successful. You only pay when you receive your refund. The table below show exactly how the fees are calculated:

Illustrative examples